wisepowder's blog

According to the latest figures, both API and EIA inventories have swelled with the latter up to 500.4 million barrels. In addition, the total oil rigs in the U.S. have decreased to 180 and the demand for crude oil has entered a phase of slowing growth, said Baker Hughes, a U.S. energy services firm.

The monthly reports of OPEC and the IEA will be released today and tomorrow, respectively, while the oil market will keep eye on this Thursday's OPEC and non-OPEC Ministerial Meeting. Recent signals of adding output sent by Saudi Arabia and Russia have curbed further cuts in production. The meeting is expected to focus on member states' implementation of production cuts, which can hardly lift oil prices.

According to the daily chart, oil prices are supported around $36.50 and may see a rebound in the short term, whereas the downtrend seems to be enduring in the medium and long term. A breach below $36.0 is waiting ahead if oil prices again achieve a rally but hampered by the resistance of $38.50-39.0.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App:

Because the pricing of crude oil is made in American dollars internationally, changes in oil price directly affect the exchange rates of the countries. This point especially led the researches about the effects of oil price changes to focus on its effects over exchange rates.

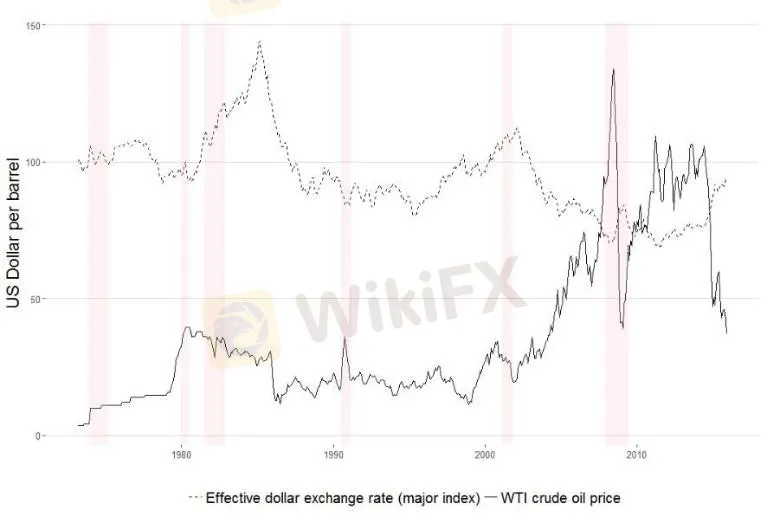

Policymakers, academics and journalists have frequently discussed the link between oil prices and exchange rates in recent years—particularly the idea that an appreciation of the US dollar triggers a dip in oil prices. Empirical research is not so clear on the direction of causation, as there is evidence for bi-directional causality. Some studies find that an increase in the real oil price actually results in a real appreciation of the US dollar, while others show that a nominal appreciation of the US dollar triggers decreases in the oil price. Figure 1 illustrates the link between the nominal West Texas Intermediate (WTI) crude oil price and the US effective dollar exchange rate index relative to its main 7 trading partners.

The terms of trade channel mostly focus on real oil prices and exchange rates, while the wealth and portfolio channels propose an effect from the nominal exchange rate to the nominal oil price. The expectations channel allows for nominal causalities in both directions.

1. The impact of oil prices on exchange rates

The terms of trade channel were introduced in 1998. The underlying idea is to link the price of oil to the price level which affects the real exchange rate. If the non-tradable sector of a country A is more energy intensive than the tradable one, the output price of this sector will increase relative to the output price of country B. This implies that the currency of country A experiences a real appreciation due to higher inflation. Effects on the nominal exchange rate arise if the price of tradable goods is no longer assumed to be fixed. In this case, inflation and nominal exchange rate dynamics are related via purchasing power parity (PPP). If the price of oil increases, we expect currencies of countries with large oil dependence in the tradable sector to depreciate due to higher inflation. The response of the real exchange rate then depends on how the nominal exchange rate changes, but relative to the impact of any changes in the price of tradable (and non-tradable) goods described above. Overall, causality embedded in the terms of trade channel potentially holds over different horizons depending on the adjustment of prices.

The underlying idea of the portfolio and wealth channel is based on a three country framework. The basic idea is that oil-exporting countries experience a wealth transfer if the oil price rises. The wealth channel reflects the resulting short-run effect, while the portfolio channel assesses medium- and long-run impacts. When oil prices rise, wealth is transferred to oil-exporting countries (in US dollar terms) and is reflected as an improvement in exports and the current account balance in domestic currency terms. For this reason, we expect currencies of oil-exporting countries to appreciate and currencies of oil-importers to depreciate in effective terms after a rise in oil prices. There is also the possibility that the US dollar appreciates in the short-run because of the wealth effect - if oil-exporting countries reinvest their revenues in US dollar assets. The short and medium-run effects on the US dollar relative to currencies of oil-exporters will depend on two factors according to the portfolio effect. The first is the dependence of the United States on oil imports relative to the share of US exports to oil-producing countries. The second is oil exporters relative preferences for US dollar assets. Figure 3 summarizes the wealth and portfolio channels.

2. Common factors driving oil prices and exchange rates

Having already explained the role of inflation, Figure 2 incorporates other common factors including GDP, interest rates, stock prices and uncertainty. A full analysis of all possible linkages and other potential factors is beyond the scope of this paper, but a few important channels are worth mentioning. GDP and interest rates both affect exchange rates and oil prices, and are also interrelated: Monetary policy reacts to GDP fluctuations while interest rate changes affect GDP through total investment and spending. An increase in GDP, all else equal, results in an increase in the oil price. Effects on exchange rates are less clear for both interest and exchange rates. A relative increase in domestic interest rates should for example depreciate the domestic currency according to uncovered interest rate parity, but the empirical evidence has demonstrated that an appreciation is frequently observed instead, reflecting the notorious forward premium puzzle. Another major influence on both the macroeconomic environment and exchange rate dynamics is the degree of uncertainty. A domestic appreciation of the exchange rate might result from uncertainty, if participants expect a currency to act as a safe haven.

Under the theories explaining the relationship between oil price and exchange rate, we see the basic supply-demand relationship. When the price of oil increases, firstly demand for dollar will increase in oil importing countries leading dollar to appreciate, but then to buy the dollar their demand for their local currencies will increase leading appreciation of their local currencies, which causes the exchange rate to depreciate. Also after getting the payment, the supply of dollar will increase in oil-exporting countries leading dollar to depreciate which causes a decrease in exchange rate, but here there are two possible follow up situations. If the oil-exporting country increases their goods import because of the depreciation of dollar, demand for the dollar will increase in the country leading dollar to appreciate causing an increase in exchange rate. However, if the oil-exporting country can‘t/doesn’t increase their goods import, then exchange rate will remain in a decreasing trend because of the depreciation of dollar.

Researchers built a theoretical dynamic partial-equilibrium portfolio model of an oil price increase influence on exchange rates in a world consisting three countries: United States of America, Germany and OPEC. According to this model, the short-run and the long-run effects of the oil price increase will be opposite such as an increase in oil price at first induces dollar appreciation but then it turns into dollar depreciation. The effect of an oil price increase on exchange rate depends on “the share of local currency in OPEC‘s portfolio”, “the share of country’s goods in OPEC imports”, and “the country‘s share in world oil imports” in this model. In the model oil imports are exogenously fixed so the effect of oil price increase will also be affected by the OPEC’s spending preferences of the money generated from oil sales. For instance; if OPEC prefers dollar payment but German goods, then the value of dollar will increase in the short-run, however will decrease in the long-run.

The most important event of the week will take place in the House of Commons. On Monday, MPs began debating changes to the Withdrawal Agreement as the amendments have riled the EU and caused heated debate within the Conservative Party.

The UK's employment/unemployment figures for July will be released at 14:00 today, while at the same time tomorrow the CPI for August will have come out. The data is expected to show price pressures easing, on which the BoE is likely to discuss at their meeting the next day.

Bullish price action from the end of June was comprehensively broken last week and there is little support before the 200-DMA. With volatility picking-up over the last few weeks as well as the releases of previously mentioned events and data, the pound may stage a volatile performance this week.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX

The outbreak and spread of COVID-19 caused oil prices to plummet, with futures prices dropping to a negative value for the first time in history. The demand for energy consumption fell sharply mainly due to governments‘ measures of lockdown and social distancing orders that restricted people to travel and put countries’ aviation industry into a battle to survive.

The International Energy Agency (IEA) forecasts global oil demand will decrease by an average of 8 million barrels/day this year, or about 8% lower than last year. Although the IEA estimates oil demand will increase by 5.7 million barrels/day next year, overall demand will remain lower than in 2019 due to ongoing uncertainty in the aviation sector.

This gloomy outlook has made many observers question whether market demand can return to 2019 levels? The concept of oil at its peak has long been the subject of discussion. Experts mainly focus on production peaks, with forecasts that oil prices will skyrocket when underground oil resources are exhausted.

But in recent months, the concept of a demand peak has emerged, after the COVID-19 pandemic wiped out the fuel demand of the transport industry, plus those efforts to move to cleaner fuel sources. Environmental groups have been campaigning to stop the Paris Agreement on climate change from becoming another victim of the COVID-19 pandemic, said Professor Michael Bradshaw at the Warwick Business School (UK), at the same time emphasized the need for a Green New Deal in the economic recovery process.

Professor Bradshaw argues that if environmental groups succeed, demand for “black gold” may never return to the highest levels ever recorded before the COVID-19 pandemic. Meanwhile, the transport sector may never fully recover, and after a pandemic, people may have different attitudes toward international air travel or work habits.

According to IEA CEO Fatih Birol, many people including CEOs of several large companies think that with today's lifestyle changes, oil demand may have peaked and will begin to drop. Meanwhile, the oil industry may face financial challenges.

Bronwen Tucker, an analyst at the non-governmental organization Oil Change International (OCI), said the oil industry is under great pressure from investors. “The giant” Royal Dutch Shell (UK-Netherlands) said last week that the asset value of this business has decreased by about 22 billion USD when reassessing the value of the business under the influence of COVID-19. Last month, Britain's BP also announced the net worth of the oil and gas conglomerate decreased by $ 17.5 billion. While China actively buys crude oil when it is so cheap and so that the tanker congestion has formed at sea.

China is currently the world's second largest oil consumer after the US. As of June 29, the country has accumulated 73 million barrels of oil, which is stored in 59 ships floating at sea, according to data from ClipperData - the company tracks the movement of crude oil at sea in real time. This is equivalent to three-quarters of the world's demand.

The recently landed oil was probably purchased in March and April, when oil prices plummeted due to the pandemic. WTI US crude oil dropped to negative on April 20 for the first time in history.

China's floating oil storage - which includes barrels of oil waiting on board for seven days or more - has nearly quadrupled since the end of May, according to ClipperData. This is not only a record number since the beginning of 2015, but also 7 times higher than the monthly average in the first quarter of 2020.

The storage of oil at sea shows that China is making a profit when the world energy market falls into a period of extreme crisis. “China is buying massive globally,” said Matt Smith, director of cargo strategy at ClipperData. “The number of oil at sea is growing rapidly.”

Smith also said China's inland oil depots were not even filled yet. “This was simply due to an out-of-port congestion. So many tankers arrived that they couldn't bring it ashore in time,” he explained.

The main buying power of China has partly pulled up the oil market. Just 7 weeks after falling to a negative of nearly $40, US crude oil rose again to $40 a barrel. The difference of 80 cent USD was created by the unprecedented reduction in production by OPEC and Russia, the world lockdown situation was loosened and demand from China increased sharply.

Most of the interior designers these days are all about selling their glossy designs coupled with visually appealing marketing collaterals. They need to understand that interior design is not all about selling a design it’s about expressing an idea. One of the most powerful tools to express such a view in 3D Interior Rendering. After reading this article, you will get know-how 3D rendering can bring revolution in your home interior design.To get more news about design rendering services, you can visit <b>https://www.3drenderingltd.com</b> official website.

3D interior design rendering is used most of the interior designers

since it helps the designer’s thoughts and views to the customer.

Earlier interior designers would have to prepare some excellent sales

speech to bag contracts. Now with technological advancements, interior

designers find it easier to engage their clients. With the help of

architectural 3D Interior Designers can make their designs more factual,

more straightforward to understand, and impactful.

1. Competitive advantage

Now if you are an interior designer yourself and you are really in the mood to score some big contracts then taking the help of some of the best 3D rendering services like Rayvat will make your team dream come true. They will make use of the 3D rendering and make your project larger than life. Once your project is complete, you will be able to show the client more exceptional details of your plan and close the deal.

2. More vision

This one of the most significant advantages of 3D interior design rendering. While your rivals only talk about an idea. You with the knowledge of 3D Rendering Services will be able to show the client the future. Meaning you will be able to create a stunning presentation that will automatically double the chances of winning the project.

3. Good relation

Once you have learned how to do 3D interior design rendering your client and you can work in peace. The client can suggest some changes, and you can make them instantly and then present it how he likes it. Thus the 3D interior rendering would not only develop strong bonds but also help in communicating upfront.

4. Fast approval and realistic expectations

3D interior design rendering will help you express the future. Meaning that you will be able to portray every minute detail of the project. Once the client sees such more beautiful details, the client will already know what the outcome will be.

The client will get a realistic expectation of the project which is very necessary if the project needs to have a favorable outcome. Now one of the added advantages of 3D interior rendering is faster approval of the plan because the client has witnessed all the possibilities of the project through 3D rendered images.

SEBI's New Margin Rule and the Key Highlights for Investors

After a meeting with brokers, depositories and clearing corporations on Monday, the capital market regulator Securities and Exchange Board of India (SEBI) decided to go ahead with its new margin pledge rules from September 1, 2020.To get more news about WikiFX, you can visit wikifx official website.

1) Buying and selling of shares will Require Upfront margin from now onwards .

Eg:

If you want to buy Reliance shares worth 1 lakh you must have 20k rs

in your account as cash and rest money to be paid within 2 days...

If you want to sell 1lakh worth of Reliance shares from your holdings

for that scenario also you must have min 20k rs in your account, Failing

which penalties will be levied.

Selling from holding will also require Upfront margin in cash (Var+ELM)

You can keep extra cash / or can pledge other holdings for the stipulated margin required.

2) Shares bought today cannot be sold Tomorrow.

For example: You bought Reliance On monday..You can only sell those

shares after recieving the delivery of shares. T+2 you can sell in

Wednesday

You can only sell the shares after you receive in Your DP/only after receiving the delivery of shares.

3) Shares Sold Today from delivery...the funds cannot be used for new

trades today.. You can use the funds for new trades when you get pay

out

You sold 10,000 worth of Reliance's shares today. You cannot

use this money to buy fresh shares of other companies. This 10000 you

can use the money when you get payout.

Chance for USD/GBP/AUD Upside as JPY Strength Limited

Japanese

firms slashed spending on plant and equipment by the most in a decade in

the second quarter, the government said on Tuesday. As a result, the

strength of the Yen was limited while the USD/JPY staged a flat

performance and consolidated around 105.70.To get more news about WikiFX, you can visit wikifx official website.

“Abenomics” is much more likely to see an end ahead of the news that

Abe suddenly resigned his post, which put a premium on the Yen at once

but later revealed to be unrealistic for markets. As the core of

Abenomics, the Yens depreciation pushes domestic prices up and stimulate

the production of companies.

However, Japan's second-quarter

Capex falls most in decade, as reported on Tuesday. In addition, the

strength of JPY will be limited considering other challenges ahead of

Japan such as shrinking workforces and the indefinite postponement of

Olympic Games.

In terms of USD/JPY, the rate is expected to see a further growth

once finding the stability above the level of 104.00 in view of the

strong support ever achieved around the level.

In terms of

EUR/JPY, the rate is now stay in the ascending channel but may hit the

resistance zone of 129.0-130.0 in future tradings if the support is

continuously gained at the lower band of 125.0.

The exchange rate

of AUD/JPY shows a more complex picture. Its short-term uptrend is

expected to suffer a setback as it is currently approaching the

resistance level of 78.60. While in the medium term, gains will be

extended in future tradings if it stays constructive below the 76.60

level.

All the above is provided by WikiFX, a platform

world-renowned for foreign exchange information. For details, please

download the WikiFX App: bit.ly/WIKIFX

A Visit to Forex Broker BP Prime in London

An investor lately

asked WikiFX to verify the regulatory information and business

conditions of the British broker BP Prime. In response to the trader,

WikiFX decided to visit the broker BP Prime in London.To get more news

about WikiFX, you can visit wikifx official website.

Broker introduction

BP Prime was founded in 2013. Headquartered in London, it has offices

in Italy and China with clients across Europe, Asia and South America,

providing contracts for difference of forex, commodities and crypto

currencies.

Great Eastern Street, where is only 20 minutes away from

the central London, has become commercialized to a great extent. Along

the way, it was found that the entire street has bristled with

high-grade office buildings. The investigator arrived at the building

numbered 62 under the help of navigation. Does BP Prime really work

here?

Entering the building, the investigator noticed that all the

entrance, reception and floors have been refurbished. The building was

accessible only by swiping its card and there were security guards

around. With advance reservation, the investigator was soon received by

the staff of BP Prime.

After getting into its office, the investigator observed that many

employees were orderly working on computers, with various documents

neatly stacked next to them. The overall environment was clean and

comfortable as the office was also equipped with a rest area and a

tearoom.

This visit confirms that the broker BP Prime is a real

one and its business address is in line with that on the regulatory

information. On the WikiFX APP, BP Prime has been rated 6.86. It is

currently under valid supervision with the Straight-Through-Processing

(STP) license of the FCA.

So far, as a popular APP among investors,

WikiFX has included profiles of more than 20,000 forex brokers around

the world while integrating forum, exposure, query, news feed and other

functions.

Relationship Between Abe and Japanese Yen

Shinzo Abe, the

longest-serving Japanese Prime Minister in history, has suddenly

resigned on August 28, citing health reasons. He will remain in his post

until a successor is chosen. Mr Abe said he would still participate in

the parliamentary vote and would not completely withdraw from

politics.To get more news about WikiFX, you can visit wikifx official website.

On September 26, 2012, Shinzo Abe was elected as the president of the

Liberal Democratic Party and won the general election later on December

26 in the year. After he became the president, the Japanese yen shrank

from the peak of 77.13, while after he became the Prime Minister, the

country‘s currency kept slipping till June, 2015 and bottomed at 125.86.

The reason is the well-known 'Abenomics', which aimed to stimulate

Japan’s exports and prevent the worsening deflation by exerting a big

depreciation in the value of the currency.

Japan‘s economy once recovered because of the Abenomics, and

investors even regained confidence amid the successful Olympic bid.

However, no one has ever expected that the outbreak of COVID-19 would

completely destroyed the Abenomics and made Abe drained and resign from

his post. After Abe announced his resignation, forex traders bought the

yen aggressively as no one could anticipated who’s his successor and

whether the following policy would be in line with Abes.

On the

other hand, Japan‘s stock markets went into a tailspin on the news of

August 28. With the unwinding of carry trade and the rising risk

aversion, the yen appeared to be strong and popular again. Under the

Japan’s uncertain political situation coupled with the continued

weakness of the U.S. dollar, the yen has the opportunity to maintain its

strength in the short term and challenge the two major resistance

levels of 104.19 and 101.48.

Whether you’re running a 200-person firm or just starting out as a solopreneur, using the best interior design software will go a long way toward helping you achieve success. You already know that the best projects are accomplished when designers, clients, and vendors are all on board from the get-go; now it’s time to apply that level of organization and collaboration to the back end of your business too. Solid design software will help you not only put together spectacular creative work, but also run your business smoothly behind the scenes. That means project management, financial organization, and productivity-boosting programs that will help you get your work done on time and on budget. From CAD tools to client management apps, here are 18 of the best interior design software programs to use now.To get more news about design rendering services, you can visit https://www.madpainter.net official website.

AutoCAD LT is one of the most popular software applications used by interior designers, architects, engineers, construction professionals, and more. This reliable software allows professionals to design, draft, and document precise drawings with 2D geometry. A comprehensive suite of editing and annotation tools and an intuitive user interface are what make this a top designer pick. An integrated AutoCAD web application with a simplified interface—and no software installation required—lets you work on sketches online from almost any computer. With the mobile app, users can view, edit, annotate, and create drawings anytime, even offline, on a smartphone or tablet. AutoCAD LT is compatible with both Mac and Windows operating systems, and the most recent version also offers cloud connectivity, an updated measurements functionality, and faster performance time.

With SketchUp Pro’s modeling suite, design professionals will find fast, easy 3D modeling for anything from passive buildings to contemporary furnishings. Create detailed scaled drawings in 2D, then add custom styles and materials that will bring your vision to the screen. SketchUp integrates with virtual reality applications (including Microsoft HoloLens, HTC Vive, and Oculus), so you can walk clients through projects in astounding detail. In addition to its classic desktop software, SketchUp also offers a web tool and unlimited cloud storage, so you can easily store, collaborate, and share work. The software also enables designers to measure building data and analyze anticipated energy use, daylighting, occupant thermal comfort, and HVAC, so you can accurately determine performance and hit post-occupancy goals. On a budget? A free version of the software offers a lighter-weight web-based option.

The latest versions of TurboCAD offer professional software for experienced 2D and 3D CAD users. The architectural design suite includes parametric architectural objects, sections, and elevations, with increased functionality to both the architectural and mechanical areas of the program. Available for both Mac and Windows operating systems, TurboCAD bills itself as “a powerful alternative” to AutoCAD LT, and setup wizards promise a simple transition for those switching from one to the other. TurboCAD prides itself on its photorealistic surface modeling and lighting that allow one to create powerful presentations, and those designing with sheet metal or wood may particularly enjoy these materials-specific tools. Internal and external database connectivity, along with file-sharing options (including support for files from Autodesk, SketchUp, and others), mean your team can integrate and collaborate at a high level with ease.

Ready to take full artistic control of your renderings? With Autodesk’s 3ds Max, clients will experience your proposed work in beautiful, high-tech detail. The software delivers superb graphics for 3D animations and models, as well as games and images. Use the tool sets here to shape and define dramatic environments and objects and create immersive worlds, stunning visualizations, and engaging virtual experiences. The integrated, interactive Arnold renderer allows users to view accurate and detailed previews while they work. And when it comes to productivity, automated processes can help streamline deadlines and content production, so you can spend more time being creative and less time managing workflow. This software is compatible with Windows only.