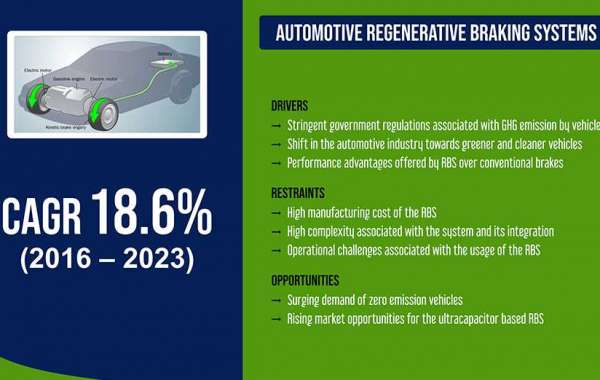

The stringent government policies implemented for controlling greenhouse gas (GHG) emissions from vehicles and a shift toward cleaner vehicles are the key factors driving the growth of the automotive regenerative braking systems (RBS) market. In 2017, the market generated a revenue of $6,555.6 million, and it is predicted to progress at a CAGR of 18.6% during forecast period 2017–2023. These systems convert kinetic energy into electricity to charge the vehicle’s battery.

Based on storage type, the automotive regenerative braking systems market is categorized into ultracapacitors, batteries, flywheels, and hydraulics. Out of these, in 2017, the batteries category held the largest revenue share, of more than 70.0%, and it is predicted to maintain its dominance during the 2017–2023 period. This is attributed to the high installation rate of battery-based RBSs in passenger cars. However, ultracapacitors have superior charge-discharge properties, and even at –40 °Celsius, they burst high power, which is why these are anticipated to be the fastest growing category during the forecast period.

On the basis of vehicle type, the automotive regenerative braking systems market is bifurcated into passenger cars and commercial vehicles. Of the two, the passenger cars bifurcation is anticipated to lead the market during 2017–2023. This is ascribed to the accelerating sale of hybrid and electric passenger cars and extensive installation of RBS systems in these vehicles. Further, due to stringent government regulations, many automotive manufacturers have started using RBS in their vehicles to curb the GHG emission and boost fuel efficiency.

For instance, in 2015, the European Union (EU) implemented regulations focusing on a decarbonized transportation system. The policies aim at controlling the carbon dioxide emission to 95 grams per km for all passenger cars by 2021. Furthermore, as per the regulation, automakers are liable for fines (excess emission premium) which shall be levied as $105.07 for the first crossed CO2 gram from 2019 onward. Besides, in order to encourage eco-friendly components, EU has started an incentive program, called Supper Credit, for automakers who limit the carbon emission below 50 grams per km.

Further, the surging number of vehicles on the roads have resulted in the rapid depletion of fossil fuel reserves. To check the reduction, various legislative bodies around the world have formulated regulations to control the fuel consumption per vehicle. For instance, in 2015, the European Commission regulated the fuel usage to 4.1 liters (petrol) for every 100 km and 3.6 liters (diesel) for passenger cars for each 100 km till 2021.

RBS stores around half the vehicle’s kinetic energy lost during traditional braking and decreases the fuel consumption by up to 30.0%. The retained energy is saved in energy storage units and used for various other applications, such as supplying power to headlights and phone charging units and for the start-stop process. Thus, in order to follow government regulations, the automobiles are being installed with RBS to reduce the GHG emission and increase fuel economy, thereby resulting in the growth of the automotive regenerative braking systems market.

Hence, stringent government regulations and increasing adoption of RBS in the automobiles is augmenting the market growth.